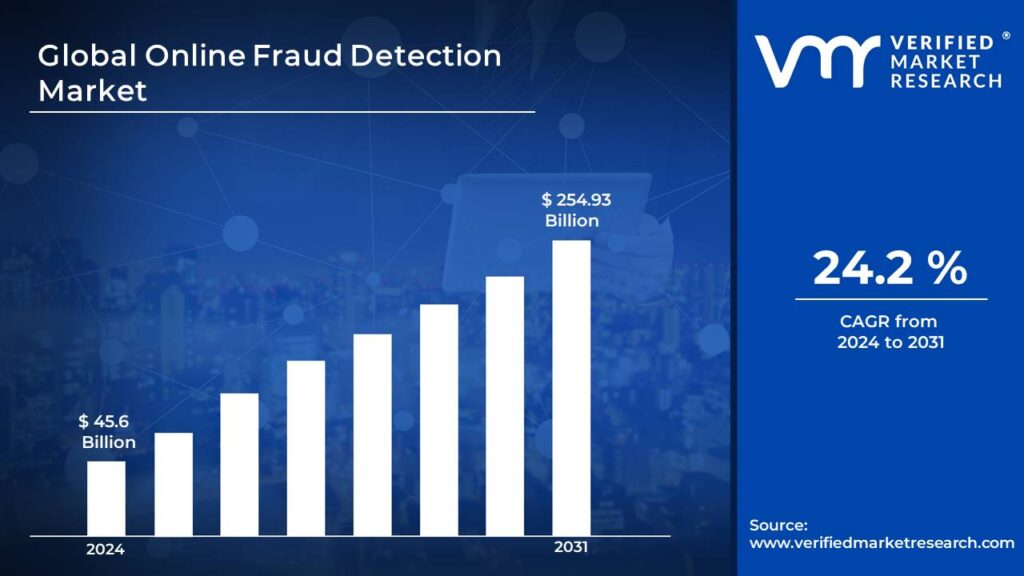

Online Fraud Detection Market is expected to generate a revenue of USD 254.93 Billion by 2031, Globally, at 24.2% CAGR: Verified Market Research®

The Online Fraud Detection Market is witnessing significant growth driven by the surge in e-commerce activities, increasing adoption of digital payment solutions, and rising cases of identity theft and financial fraud. However, high implementation costs and integration complexities of advanced fraud detection systems remain major restraints impacting widespread adoption.

Lewes, Delaware, Nov. 06, 2025 (GLOBE NEWSWIRE) -- The Global Online Fraud Detection Market Size is projected to grow at a CAGR of 24.2% from 2024 to 2031, according to a new report published by Verified Market Research®. The report reveals that the market was valued at USD 45.6 Billion in 2024 and is expected to reach USD 254.93 Billion by the end of the forecast period.

For a detailed analysis of Industry Trends And Growth Drivers, Explore The Full Online Fraud Detection Market.

For a detailed analysis of Industry Trends And Growth Drivers, Explore The Full Online Fraud Detection Market.

Browse in-depth TOC

202 - Pages

126 – Tables

37 – Figures

Global Online Fraud Detection Market Overview

Market Driver

1. Rising Incidents of Digital Payment Frauds and Cyber Threats

The surge in online transactions across industries such as banking, e-commerce, and digital services has significantly increased vulnerability to cyberattacks. With the growing adoption of digital wallets, mobile banking, and contactless payments, fraudulent activities like phishing, identity theft, and account takeovers are escalating rapidly.

- Businesses are now prioritizing fraud prevention solutions to safeguard consumer data and financial assets.

- The integration of real-time fraud monitoring tools has become essential to detect and mitigate threats promptly.

- Financial institutions are heavily investing in advanced authentication and behavior analytics to counter cybercrime.

- As a result, the need for robust fraud detection systems is expanding, creating lucrative opportunities for solution providers and investors in the Online Fraud Detection Market.

- This increasing awareness of digital payment security is driving enterprises worldwide to adopt scalable, AI-enabled fraud detection systems that enhance trust, reduce losses, and ensure compliance with evolving data protection regulations.

2. Growing Adoption of AI and Machine Learning for Real-Time Detection

Artificial Intelligence (AI) and Machine Learning (ML) technologies are transforming the landscape of fraud prevention and detection. These intelligent systems help organizations analyze vast amounts of transaction data to detect anomalies that traditional rule-based systems often miss.

- AI-based platforms continuously learn from past transactions to improve detection accuracy and minimize false positives.

- Businesses are leveraging predictive analytics to identify suspicious activities before financial losses occur.

- The automation of fraud detection through AI and ML enables faster decision-making, optimizing operational efficiency.

- Such advanced systems not only secure digital transactions but also improve customer experience by reducing unnecessary transaction delays.

- As digital transformation accelerates across sectors, the adoption of AI-driven fraud detection tools is becoming a strategic necessity. This ongoing technological evolution is fueling significant demand in the Online Fraud Detection Market and redefining cybersecurity strategies for global enterprises.

3. Expansion of E-Commerce and Digital Banking Ecosystems

The exponential rise in e-commerce and digital banking has made fraud detection a critical component of online business operations. With millions of daily transactions occurring globally, businesses are increasingly exposed to fraudulent activities like fake refunds, payment diversion, and identity spoofing.

- E-commerce platforms are investing in fraud detection systems to maintain customer trust and ensure secure transactions.

- Financial institutions are integrating real-time fraud prevention tools into mobile and online banking systems.

- The shift towards digital-first consumer behavior has accelerated the demand for scalable and cloud-based fraud detection solutions.

- Compliance with stringent banking and financial regulations further encourages adoption across BFSI and fintech sectors.

- This growing digital commerce ecosystem, combined with the rise of omnichannel transactions, continues to propel market expansion. Companies prioritizing fraud detection are better positioned to protect customer data, maintain operational integrity, and achieve sustainable growth in a competitive digital economy.

Download a free sample to access exclusive Insights, Data Charts, And Forecasts From The Online Fraud Detection Market Sample Report.

Market Restraints

1. High Implementation and Maintenance Costs

Despite the growing need for online fraud prevention, high setup and maintenance costs remain a major barrier for many organizations, particularly small and medium enterprises (SMEs). Implementing advanced fraud detection systems requires heavy investment in infrastructure, software, and skilled personnel.

- Continuous updates and threat intelligence monitoring further increase operational costs.

- Integration with legacy systems often demands custom development and additional technical resources.

- Many SMEs find it challenging to allocate large budgets for cybersecurity initiatives amid tight profit margins.

- These high expenses limit the adoption of advanced fraud detection tools in cost-sensitive regions.

- Consequently, while large enterprises continue to expand their investments in fraud prevention, small businesses lag behind, leading to uneven market growth. Over time, vendors offering affordable, modular, and cloud-based solutions may help overcome this financial restraint.

2. Integration Complexities with Existing IT Infrastructure

Integrating fraud detection systems with existing IT frameworks presents significant technical challenges. Many enterprises operate on outdated legacy systems that are not easily compatible with modern fraud detection technologies.

- Data fragmentation and inconsistent system architecture hinder seamless implementation.

- Integration delays often result in longer deployment cycles and increased project costs.

- Businesses may face reduced system efficiency and scalability due to poor interoperability.

- Lack of skilled IT professionals to manage integration processes adds further complexity.

- These challenges slow down the digital transformation process for many organizations and discourage immediate adoption of advanced fraud detection tools. As a result, the integration barrier continues to restrain overall market penetration, especially in traditional banking and retail sectors.

3. Data Privacy Concerns and Regulatory Challenges

The growing stringency of global data protection laws, such as GDPR in Europe and CCPA in the United States, has created compliance challenges for businesses implementing fraud detection solutions.

- Companies must carefully manage how they collect, store, and analyze customer data to avoid legal penalties.

- Overreliance on user data can raise ethical and privacy concerns, potentially harming brand reputation.

- Balancing the need for fraud detection with data privacy obligations often leads to limited data access, reducing analytical precision.

- Evolving regional regulations make it difficult for multinational companies to maintain consistent security practices.

- These concerns hinder innovation and delay technology adoption in certain industries. As privacy awareness among consumers rises, companies must invest in transparent, compliant, and privacy-preserving fraud detection technologies to stay competitive in the global Online Fraud Detection Market.

Geographical Dominance: North America dominates the Online Fraud Detection Market due to the rapid digitization of financial services, strong presence of cybersecurity vendors, and high adoption of AI-driven fraud prevention solutions across the U.S. and Canada. Europe follows closely, driven by stringent data privacy laws like GDPR and increasing online payment activities. Meanwhile, the Asia-Pacific region is experiencing the fastest growth, fueled by expanding e-commerce ecosystems in India, China, and Japan, alongside government initiatives promoting digital transactions and secure financial infrastructure.

Key Players

The “Global Online Fraud Detection Market” study report will provide a valuable insight with an emphasis on the global market. The major players in the market are FICO, TransUnion, BAE Systems, Kount, Inc., Nice Actimize, LexisNexis Corporation, Software AG, Capgemini SE, RSA Security LLC, DXC Technologies.

Online Fraud Detection Market Segment Analysis

Based on the research, Verified Market Research has segmented the global market into Fraud Type, Application, and Geography.

-

Online Fraud Detection Market, by Fraud Type:

- Credit/debit card frauds

- Identity theft, cheque frauds

- Frauds from external vendors & contractors (exaggerated/fake bills, rigging of bids)

- Data breaches & theft of intellectual property

- Medical claims

- Tax frauds

- Bankruptcy frauds

- Fake insurance claims

- Unsecured loans

-

Online Fraud Detection Market, by Application:

- Banking

- Insurance

- Medical

- Government agencies

- Law enforcement

-

Online Fraud Detection Market, by Geography

-

North America

- U.S

- Canada

- Mexico

-

Europe

- Germany

- France

- U.K

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

ROW

- Middle East & Africa

- Latin America

-

North America

Strategic Insight:

The Online Fraud Detection Market is expanding rapidly as digital transactions surge across industries. Key drivers such as AI-based real-time monitoring, the rise of e-commerce, and the need for cybersecurity compliance are fueling market adoption. However, challenges like high implementation costs, integration complexities, and privacy regulations hinder full-scale deployment. North America leads the market, while Asia-Pacific presents strong growth potential. For new entrants and investors, focusing on cloud-based, cost-efficient, and regulation-compliant solutions offers major growth opportunities, helping businesses enhance transaction security and gain a competitive edge in the global digital economy.

To gain complete access with Corporate Or Enterprise Licensing, Visit The Online Fraud Detection Market.

Key Highlights of the Report:

- Market Size & Forecast: In-depth analysis of current value and future projections

- Segment Analysis: Breaks down the market by Fraud Type, and Application for focused strategy development.

- Regional Insights: Comprehensive coverage of North America, Europe, Asia-Pacific, and more

- Competitive Landscape: Profiles key players, their strategic initiatives, and innovation-driven growth approaches.

- Growth Drivers & Challenges: Analyzes the forces accelerating growth and the restraints hindering large-scale adoption.

- Challenges and Risk Assessment: Evaluates ethical debates, off-target effects, and regulatory complexities.

Why This Report Matters?

This report provides in-depth insights into evolving fraud detection technologies, competitive benchmarking, and market forecasts. It helps decision-makers design data-driven strategies, identify growth opportunities, and mitigate risks in an increasingly digital business landscape.

Who Should Read This Report?

- Cybersecurity solution providers

- Financial service institutions

- E-commerce and fintech executives

- IT leaders and risk management professionals

- Market research analysts and B2B strategists

Browse Related Reports:

Global Online Fraud Detection Software Market Size By Fraud Type (Account Takeover, Credit Card Fraud, Identity Theft, Data Breaches, Phishing), By Technology (Machine Learning, Artificial Intelligence, Behavioral Analytics, Big Data Analytics, Biometric Authentication), By Transaction Type (Online Transactions, Mobile Transactions, Point-of-Sale (POS) Transactions), By End-User Industry (BFSI, IT and Telecom, Retail and Consumer Packaged Goods, Government, Real Estate and Construction, Energy and Utilities), By Geographic Scope And Forecast

Global Voice Biometrics Market Size By End Use Industry (Financial Services, Healthcare), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Authentication, Fraud Prevention), By Geographic Scope And Forecast

Global Fraud Detection And Prevention Market Size By Mode of Deployment (On-premises, Cloud-based), Size of Organization (SME, Big businesses), Sector (BFSI, Retail and E-commerce, IT and telecom, Healthcare), By Geographic Scope And Forecast

Global Telecom Cybersecurity Market Size By Component (Solutions, Services), By Security Type (Network Security, Endpoint Security, Application Security, Cloud Security), By Application (Network Infrastructure, Data Protection, Fraud Management, Regulatory Compliance), By Geographic Scope and Forecast

Top 7 Fraud Detection And Prevention Companies revolutionzing secured transactions

Visualize Online Fraud Detection Market using Verified Market Intelligence -:

Verified Market Intelligence is our BI Enabled Platform for narrative storytelling in this market. VMI offers in-depth forecasted trends and accurate Insights on over 20,000+ emerging & niche markets, helping you make critical revenue-impacting decisions for a brilliant future.

VMI provides a holistic overview and global competitive landscape with respect to Region, Country, Segment, and Key players of your market. Present your Market Report & findings with an inbuilt presentation feature saving over 70% of your time and resources for Investor, Sales & Marketing, R&D, and Product Development pitches. VMI enables data delivery In Excel and Interactive PDF formats with over 15+ Key Market Indicators for your market.

About Us

Verified Market Research® stands at the forefront as a global leader in Research and Consulting, offering unparalleled analytical research solutions that empower organizations with the insights needed for critical business decisions. Celebrating 10+ years of service, VMR has been instrumental in providing founders and companies with precise, up-to-date research data.

With a team of 500+ Analysts and subject matter experts, VMR leverages internationally recognized research methodologies for data collection and analyses, covering over 15,000 high impact and niche markets. This robust team ensures data integrity and offers insights that are both informative and actionable, tailored to the strategic needs of businesses across various industries.

VMR's domain expertise is recognized across 14 key industries, including Semiconductor & Electronics, Healthcare & Pharmaceuticals, Energy, Technology, Automobiles, Defense, Mining, Manufacturing, Retail, and Agriculture & Food. In-depth market analysis cover over 52 countries, with advanced data collection methods and sophisticated research techniques being utilized. This approach allows for actionable insights to be furnished by seasoned analysts, equipping clients with the essential knowledge necessary for critical revenue decisions across these varied and vital industries.

Verified Market Research® is also a member of ESOMAR, an organization renowned for setting the benchmark in ethical and professional standards in market research. This affiliation highlights VMR's dedication to conducting research with integrity and reliability, ensuring that the insights offered are not only valuable but also ethically sourced and respected worldwide.

Follow Us On: LinkedIn | Twitter | Threads | Instagram | Facebook

Mr. Edwyne Fernandes Verified Market Research® US: +1 (650)-781-4080 US Toll Free: +1 (800)-782-1768 Email: sales@verifiedmarketresearch.com Web: https://www.verifiedmarketresearch.com/ SOURCE – Verified Market Research®

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.